What are the Benefits of Cryptocurrency?

Cryptocurrency has revolutionized finance, offering unparalleled advantages. Digital currencies, like Bitcoin and Ethereum, facilitate secure, decentralized transactions. They transcend borders to empower individuals with financial autonomy. Cryptocurrencies work on blockchain technology which guarantees transparency and immutability.

They redefine efficiency through minimal transaction fees and swift processing. Investors enjoy high returns possibilities as well as diversification opportunities for their investment portfolios. A future that promises a dynamic and prosperous future.

Let’s explore together the fascinating world of cryptocurrency in this blog.

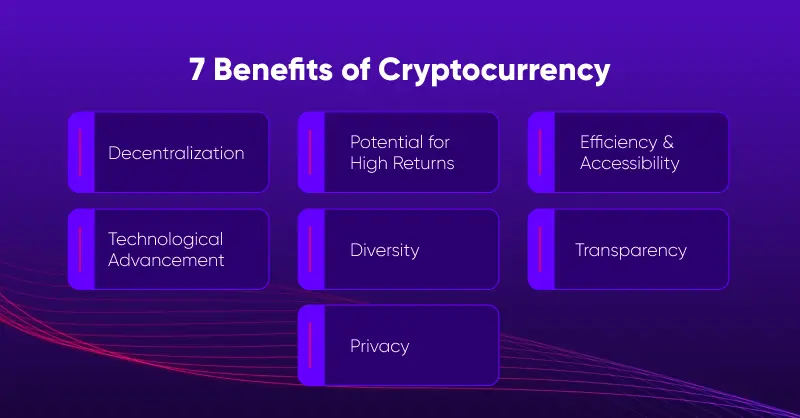

Top 7 Benefits of Cryptocurrency

The following outlines the profound benefits of cryptocurrency that are transforming contemporary financial paradigms:

Decentralization

Cryptocurrency decentralization refers to a system where trust is founded through peer-to-peer transactions. Cryptocurrencies are not governed by central authorities like traditional ones but employ distributed networks to operate networked economies.

In this framework, transparent and secure trades are carried out through unchangeable blockchains. These digital assets eliminate intermediaries from all systems, allowing individuals to handle their finances entirely through these virtual currencies.

Decentralization enhances financial inclusion by facilitating worldwide banking access for unbanked individuals. Investors have embraced Bitcoin due to its potential for high returns and market growth. Investors have embraced Bitcoin due to its potential for high returns and market growth.

Potential for High Returns

The following section outlines some reasons why investors are drawn to cryptocurrencies as an investment option due to their potential for high returns. Traditional securities do not have this kind of volatility meaning they tend to rise gradually over time. Current price shifts can lead to significant gains within short periods. It happens because most cryptos are limited in supply providing them with long-term value despite market volatility. All the same, strategic investments could minimize such risks associated with market shifts and regulatory uncertainties.

Efficiency and Accessibility H3]

Efficiency and accessibility are hallmarks of cryptocurrency. Transactions involving digital money use instant technologies. Therefore, conventional bank transfers which require longer turnaround times are different from crypto transfers whose duration is instantaneous. In this regard, speed acts as an enhancer of efficiency in that it promotes the movement of money across borders at a high rate.

In addition to this, cryptocurrencies can be accessed by those who have no access to traditional banking services. An internet connection is all that is needed for anyone who wants to use cryptocurrency to take part in the global economy. Accessibility democratizes finance and gives people worldwide independence over their financial decisions.

Technological Advancements

Cryptocurrency’s growth has been driven by innovation and technological advancements. Security and efficiency are improved by these founders constantly. Some of the inventions include decentralized finance (DeFi), smart contracts, and non-fungible tokens (NFTs) which have revolutionized several industries. The impact of blockchain technology goes beyond just financial services into areas such as supply chain management, healthcare, or selection processes. This continuous innovation pushes cryptocurrency ahead in terms of technological progress thereby helping the world move forward.

Diversity

In recent years, investing in cryptocurrency has become highly profitable with the market growing exponentially. Cryptocurrencies differ from conventional assets like stocks or bonds because their records are short when compared to them. The independence of cryptocurrencies makes them valuable for diversification in investment portfolios. Balancing investments with different price trends may offer stable returns throughout time.

For instance, whenever stock markets fall, there may be a rise in the value of cryptos as a haven against losses. However, it should be noted that cryptocurrencies are by nature unstable, so investors need to tread carefully. In this way, too much dependence on cryptos may increase risk in a portfolio thus the importance of having a balanced asset allocation.

Transparency

Most digital currency transactions are anonymous thereby revealing their transparency and accountability. Cryptocurrencies, unlike conventional payment systems, are based on public ledgers allowing participants to see all transactions that happen. It is not easy for fraudsters to operate under such conditions as they create trustworthiness in these currencies.

Blockchain offers traceability of every transaction hence a clear record of ownership and movement of funds can be obtained. Such transparent practices enhance confidence in the cryptocurrency ecosystem, making more users join and trade with these coins. This has led to a more transparent financial system where information about financial activities is available.

Privacy

Cryptocurrency transactions can ensure privacy without the involvement of third parties. On the blockchain network, investors have numbers or codes rather than names so that no one else knows what they mean when conducting their transactions. Several cryptocurrencies prioritize privacy thus helping them remain anonymous by default settings as seen in Monero coin among others. Secrecy forms the basis for trust and security which allows one to manipulate their finances according to individual tastes or preferences respectively while at the same time creating an alternative mode of payment other than traditional ones.

Suggested Read: Avoiding Common Mistakes in Crypto Investment

Conclusion

In summary, cryptocurrency has become a revolutionary influence on finance due to its decentralization and confidentiality benefits among many others. Despite being highly volatile globally, interest remains high. Traders need to embrace some of these opportunities for a better financial future that will cater to everyone’s needs from different geographical areas around the world.

As the landscape continues to evolve, there cannot be enough said about how much impact crypto trading has had on traditional ideas regarding monetary matters besides investments. The potential inherent in this technology for driving change and empowering economies means that there lies ahead a dynamic future in the digital era.

Get exclusive Inveslo insights to drive your investing decisions confidently and smartly in today’s financial markets.