Gold flirts with 1% loss on Tuesday while markets see tariff fears have peaked

- Gold price dips on rumors that US President Trump will ease auto tariffs.

- More focus on key US economic data that could determine the Fed’s rate path as rate cut bets edge higher.

- Despite bearish elements starting to build up, traders still advise keeping Gold positioning.

Gold price (XAU/USD) is seeing buyers and sellers being pushed towards each other as Bullion gears up for a breakout, currently trading around $3,313 at the time of writing on Tuesday. The consolidation comes as traders and markets tweak their positioning in the precious metal ahead of a possible announcement by United States (US) President Donald Trump on car tariffs. The rumor in markets is that Trump will ease auto tariffs, which would reduce demand for Gold and ease trade tensions, Bloomberg reports.

US economic data will be the second driver this week, which will become important after the Texas Federal Reserve (Fed) Manufacturing Activity Tracker. The widely followed measure weakened significantly as participants expressed their current sentiment with words like “chaos” and “insanity”, in order to describe the turmoil spurred by Trump’s tariffs, the Dallas Fed report mentioned, according to Bloomberg.

Daily digest market movers: Bessent positive on trade deals coming

- US Treasury Secretary Scott Bessent told CNBC on Monday that the US has put China on hold for now as it seeks trade deals with between 15 and 17 other countries, while indicating it’s up to Beijing to take the first step in de-escalating the tariff fight, Reuters reports.

- On Monday, the Dallas Fed Manufacturing Business Index for April fell to -35.8, coming from -16.3. The negative doubling plunge in the sentiment index takes the indicator to levels not seen since the pandemic took place, Reuters reports. This could be one of the data points this week, together with the upcoming preliminary US Gross Domestic Product (GDP) for the first quarter due on Wednesday and the Nonfarm Payrolls (NFP) print on Friday, for the Federal Reserve to assess its policy decision for the meeting on May 7.

- China is pushing back hard against the US with the People’s Daily, the flagship newspaper of the Chinese Communist Party, saying in a commentary Tuesday morning that the US should stop its wrongdoing of imposing tariffs. Foreign Minister Wang Yi also said if nations choose to remain silent, compromise and retreat, it will only lead to the bullies making further advances, Bloomberg reports.

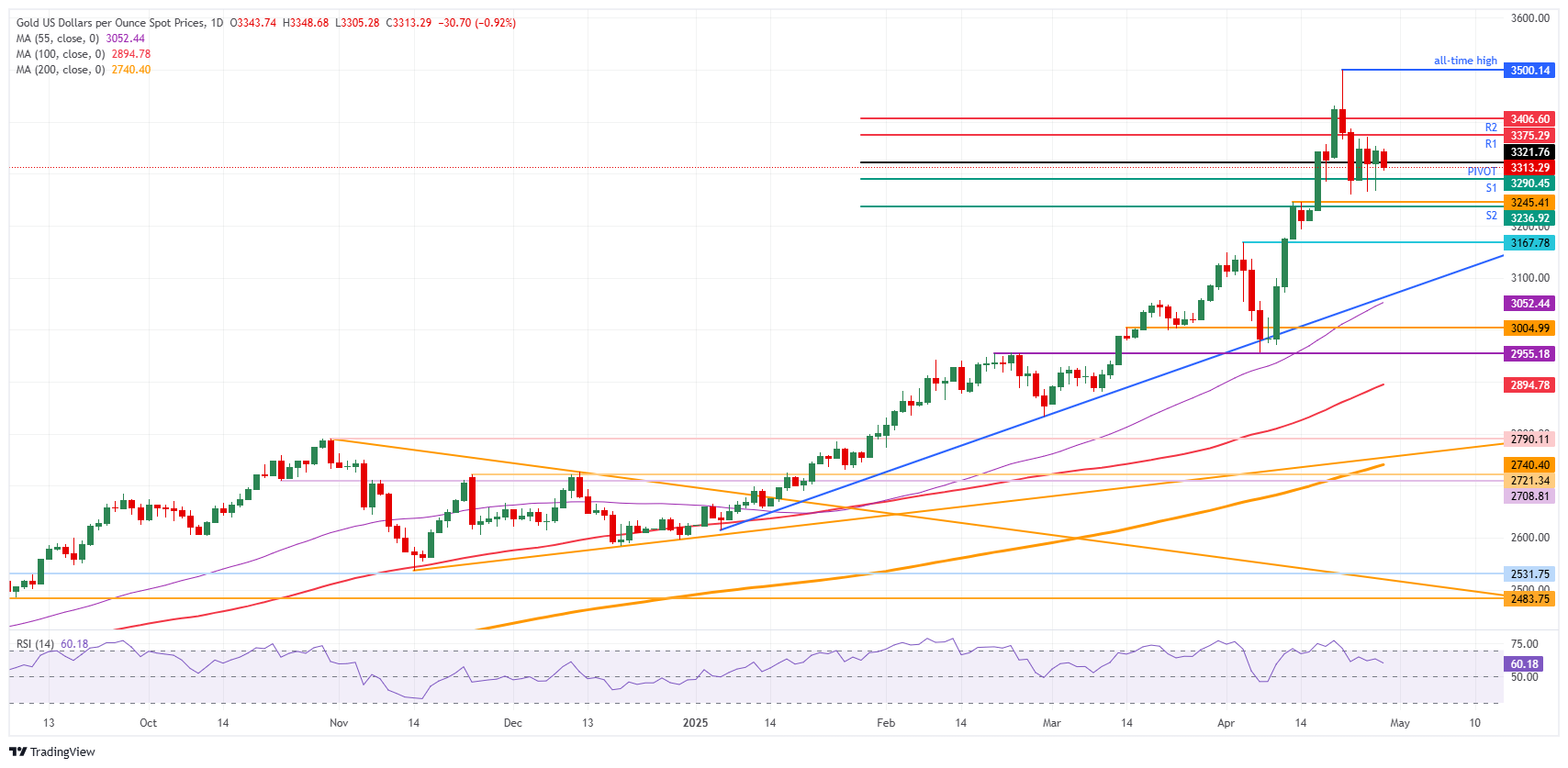

Gold Price Technical Analysis: The end of an era

To keep your hedge or not to keep it, that is the question. Clearly, the Gold rally is stalling and is starting to show signs of fatigue with traders booking profits and reducing their exposures as more and more headlines come out that the Trump administration is starting to reduce its aggressive tariffs regime, for example, with the car parts exemptions. Though, can the US ease off that much if its main competitor and reason for these tariffs, China, is unwilling to come to the table?

The daily Pivot Point at $3,322 has been tested this morning, though, for now, it tries to hold price action. From there, it is quite a stretch to $3,375 before hitting the R1 resistance. The R2 resistance at $3,406 is a near-implausible level to reach this Tuesday, as this consolidation is not yet due for a breakout.

On the downside, the S1 support is providing a cushion at $3,290. Further down, the technical pivotal floor near $3,245 (April 11 high) comes into play. Finally, the S2 support at $3236 should prevent any further downturn to the pivotal level at $3,167 (April 3 high).

XAU/USD: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.