Forex Today: US Dollar stretches higher ahead of mid-tier data releases

Here is what you need to know on Thursday, May 1:

The US Dollar (USD) continues to gather strength against its rivals early Thursday, with the USD Index advancing to a two-week-high above 100.00. The US economic calendar will feature Challenger Jobs Cuts and ISM Manufacturing PMI data for April, alongside the weekly Initial Jobless Claims. European markets will remain closed in observance of the Labor Day holiday.

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.57% | 0.13% | 0.52% | -0.41% | 0.16% | 0.54% | -0.19% | |

| EUR | -0.57% | -0.49% | -0.02% | -0.99% | -0.51% | -0.04% | -0.77% | |

| GBP | -0.13% | 0.49% | 0.44% | -0.49% | -0.04% | 0.45% | -0.28% | |

| JPY | -0.52% | 0.02% | -0.44% | -0.93% | -0.36% | -1.41% | -0.48% | |

| CAD | 0.41% | 0.99% | 0.49% | 0.93% | 0.45% | 0.95% | 0.23% | |

| AUD | -0.16% | 0.51% | 0.04% | 0.36% | -0.45% | 0.49% | -0.26% | |

| NZD | -0.54% | 0.04% | -0.45% | 1.41% | -0.95% | -0.49% | -0.73% | |

| CHF | 0.19% | 0.77% | 0.28% | 0.48% | -0.23% | 0.26% | 0.73% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

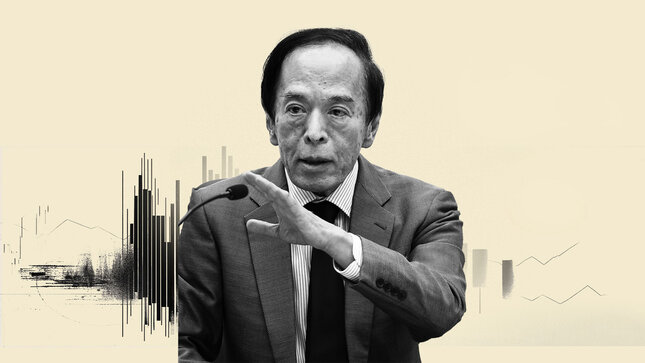

The Bank of Japan announced on Thursday that it left the short-term interest rate target unchanged in the range of 0.40%- 0.50%. In the post-meeting press conference, BoJ Governor Kazuo Ueda noted that the uncertainty surrounding the Japanese outlook heightened sharply due to the US' trade policies. Ueda reiterated that they will keep raising rates if the economy and prices move in line with their projections. USD/JPY preserves its bullish momentum and trades above 144.50 in the European morning, rising about 1% on the day.

The US Bureau of Economic Analysis' reported in its first estimate on Wednesday that Gross Domestic Product (GDP) contracted at an annual rate of 0.3% in the first quarter. Other data from the US showed that the core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's (Fed) preferred gauge of inflation, rose 2.6% on a yearly basis in March, matching the market consensus. Meanwhile, US President Donald Trump said on Wednesday that there was a very good probability that they will reach a deal with China. US Trade Representative Jamieson Greer, however, told reporters that no official talks with China were underway. US stock index futures rise between 0.5% and 1.4% in the European morning on Thursday after Wall Street's main indexes registered small gains on Wednesday.

EUR/USD stays on the back foot and trades near 1.1300 in the European session after posting losses for two consecutive days.

GBP/USD struggles to shake off the bearish pressure and retreats to the 1.3300 area early Thursday, losing about 0.3% on the day.

Gold lost nearly 1% on Wednesday and closed below $3,300. XAU/USD extends its weekly slide and trades deep in negative territory below $3,250 to begin the European session.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Forex News

Keep up with the financial markets, know what's happening and what is affecting the markets with our latest market updates. Analyze market movers, trends and build your trading strategies accordingly.